US Dollar recovers losses as markets digest Trump election victory

- Go back to blog home

- Latest

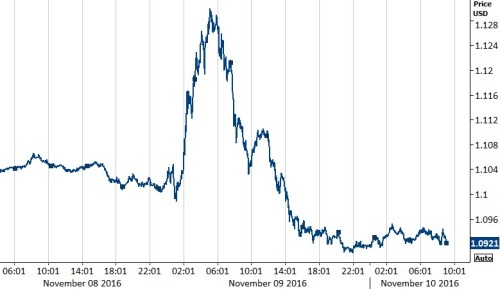

Relative calm returned to the currency markets during London trading on Wednesday after a volatile and unpredictable Asian session following the announcement that Donald Trump had been elected as the 45th President of the United States.

Figure 1: EUR/USD (08/11/2016 – 10/11/2016)

Investors didn’t quite know what to make of yesterday election result, with traders unclear as to the effect of a Trump presidency on both the US economy and its currency. Trump’s plans to deport 11 million undocumented migrants in the first 18 months of his term could drastically reduce US GDP, although some strategists have argued his planned tax cuts and protectionist proposals could be a positive in the medium term.

Despite this looming uncertainty, expectations for an interest rate hike by the Federal Reserve this year remained intact yesterday. The market began re-pricing in the possibility of a rate increase in 2016 with market implied probability of a December hike rising back to around 80% from less than 50% earlier in the day. Speeches from Fed member’s Bullard and Williams today will now take on added importance.

Wednesday’s slightly more market friendly acceptance speech from Trump also somewhat improved sentiment toward the greenback. Trump dropped much of the outlandish rhetoric that was symptomatic of his entire presidential campaign.

Meanwhile the Mexican Peso, by far the largest mover overnight on Tuesday, remained under heavy pressure yesterday following its sharp 10% sell-off. The safe-haven Japanese Yen, which strengthened sharply as markets entered into full risk aversion mode on Wednesday morning, gave up almost the entirety of its gains.

Major currencies in detail:

GBP

The Pound fell by 0.3% against the Dollar during London trading yesterday on renewed appetite for US Dollars.

Sterling also received some decent support from data that showed the UK trade deficit narrowed in the third quarter of the year, despite an overshoot in September. The recent sharp decline in the Pound, which has fallen by almost 20% against the Dollar since the Brexit vote, failed to provide a boost to exports in September, which fell by £200 million to £26.1 billion.

Political developments remain key for the Pound and we expect Sterling to continue to be driven by Brexit developments and election fallout.

EUR

The Euro slumped by 1.6% during London trading, reversing all of its post-election gains and falling to its weakest position so far this month.

Central bank member Peter Praet spoke yesterday, although failed to be drawn on the effect of the US election on the ECB’s policy. Praet reiterated the Governing Council will keep its policy accommodative until inflation returned to its close to but below 2% target.

ECB rate setter Bosjan Jazbec also made an appearance on Wednesday. Jazbec claimed that both the ECB and Federal Reserve would be able to respond to any shock from a Trump election win if needed.

German inflation data on Friday will be the main economic release in the Eurozone this week. The path of the Euro over the coming days will depend heavily on re-evaluated expectations for the next policy moves by both the ECB and Federal Reserve following the election.

USD

A recovery against almost every major currency yesterday caused the US Dollar index to end the London session 1.5% higher, comfortably above its pre-election levels.

Yesterday was dominated by election fallout and expectations for Trump’s pending Presidency, of which will officially commence in late January next year. We think it is clear that restrictions on trade will be forthcoming, and also expect a significant increase in fiscal stimulus in the US next year.

In the meantime, expectations for the next Fed hike will dominate proceedings. We think Fed officials are likely to wait and see how thing develop in the coming weeks before committing to a next policy move.

A speech from Fed member James Bullard at 14:15 UK time will be worth keeping tabs on today.

Receive these market updates via email