Sterling edges towards multi-decade lows, focus shifts to US retail sales

- Go back to blog home

- Latest

The Pound continued to edge back towards its 31 year low against the US Dollar yesterday, with far worse than expected housing data overnight keeping Sterling pinned to its one month low versus the Greenback.

The Euro rallied for the third straight session on Thursday, buoyed by comments from an IMF economist who warned that the European Central Bank has limited room for further substantial interest rate cuts without hurting commercial bank’s profitability.

Euro traders now look to this morning’s second quarter GDP and industrial production numbers. A disappointing set of growth figures is unlikely to shift the Euro too much given its datedness, although would do little to improve the currently fairly dour economic sentiment in the Eurozone.

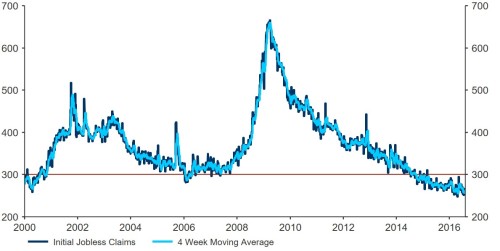

Initial US jobless claims impressed again on Thursday and were little changed for the second straight week. Claims fell by 1,000 to 266,000, extending the longest stretch below the 300,000 level since 1970 (Figure 1).

Figure 1: US Initial Jobless Claims (2000 – 2016)

Retail sales figures in the US at 13:30 UK time today will arguably be the biggest announcement in the currency markets this week. A strong enough number could bring a September interest rate hike by the Fed back into the picture and would provide impetus for a US Dollar rally today.

Major currencies in detail:

GBP

The Pound fell 0.35%, back below 1.30 against the US Dollar, while trading around its two-and-a-half year low against the Euro. However, trading volumes remain very low and economic announcements were limited during the typically quiet August month.

With focus firmly on central bank monetary policy, economists remain unconvinced that the Bank of England is done with its large scale easing measures this year. Yesterday’s poll from Reuters suggested that the central bank could cut the benchmark interest rate by a further 15 basis points to 0.1% as early as the November meeting.

We think further action from the Bank will heavily depend on the next round of PMI data, set to be released in the first week of September.

With no economic announcements in the UK today, Sterling is likely to be driven by announcements in Europe and the US. Investors will have one eye on next week’s inflation and labour data.

EUR

The Euro ended 0.1% higher for the day, with a lack of major announcements keeping volatility to a minimum.

Preliminary second quarter GDP numbers in Germany smashed expectations this morning, coming in at 3.1% YoY versus the 1.5% expected. This came despite a warning from Germany’s economy ministry yesterday that private consumption in the second quarter was likely weaker than previous due to increased external risks stemming from the Brexit vote.

We received some soft industrial production out of France yesterday, with output falling by 0.8% month-on-month against market expectation of 0.1%. Manufacturing production also came in weaker at -1.2%.

With markets in Europe closed for Assumption day on Monday, trading will likely be thin ahead of the long weekend.

USD

The Dollar index ended unchanged for the day, giving up earlier gains during morning trading.

Jobless claims again supported the claim for higher rates in the US last week. The import and export price index were also both better than expected, increasing to -3.7% and -3% year-on-year respectively.

The latest poll of economists surveyed by Reuters continued to suggest we’ll see another interest rate hike by the Fed this year, although not until the December meeting. Of the 95 economists’ surveyed, 69 were forecasting a 25 basis point hike by the end of 2016.

Retail sales and the producer price index this afternoon will be the highlight today.

Receive these market updates via email