Sterling edges lower as UK inflation comes in unrevised for July

- Go back to blog home

- Latest

The major currencies traded within a relatively narrow band on Monday with a lack of any news during typically quiet August trading leading to a quiet session of foreign exchange trading.

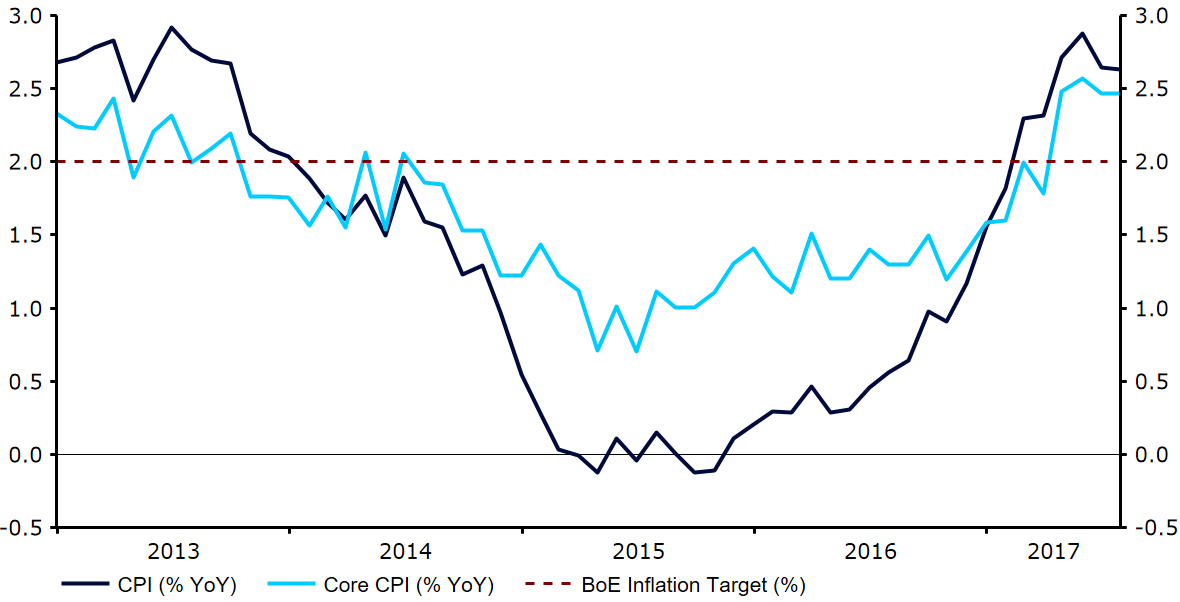

This morning’s inflation numbers led to a modest sell-off, remaining unrevised in July at 2.6% versus the 2.7% consensus (Figure 1). We continue to think that as inflation edges back towards the 3% level investors will begin to bring forward expectations for an interest rate hike by the Bank of England.

Figure 1: UK Inflation Rate (2013 – 2017)

The US Dollar was broadly stronger across the board yesterday as a return in risk appetite following last week’s developments out of North Korea led to a sell-off in the traditionally “safer” currencies. Today’s US retail sales, seen by the Federal Reserve as one of the main economic data releases of the month, could shift the currency this afternoon. Ahead of Thursday’s FOMC meeting minutes, financial markets have continued to push their expectations for the next interest rate increase by the Fed and are now pricing in the next hike as far out as June 2018.

In the Eurozone, industrial production was a slight disappointment in June with output declining 0.6% from the downwardly revised 1.2% registered in May. Thursday’s inflation numbers and European Central Bank meeting accounts are undoubtedly the main focal points of the week in Europe. In the run-up to these announcements the Euro is likely to remain fairly range bound, barring any significant new rhetoric from either Donald Trump or North Korean authorities that could provide a catalyst for a renewed shift to safe havens., Hi, I am a new blog post, you can change me, or even delete me!, it is up to you! 😉