‘Flash crash’ in currency markets as prospect of a hard Brexit clobbers Sterling

- Go back to blog home

- Latest

Currency markets were focused almost entirely on Sterling all week.

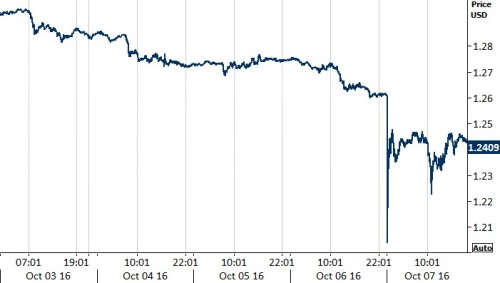

Matters were brought to a head on Thursday night, as lack of liquidity during thin Asian morning trading, algorithmic trading and stop losses brought about a two-minute 6% “flash crash” in Sterling. The currency quickly recovered most of this fall but still ended the week down over 3% against both the US Dollar and the Euro (Figure 1).

Figure 1: GBP/USD (03/10/2016 – 07/10/2016)

As currency markets are increasingly driven by political rather than economic developments, the star of the week was without doubt the Mexican Peso. It rallied sharply into the weekend as news of Trump’s embarrassing tapes hit the wires and his election prospects look ever more remote.

FX markets will continue to focus on political developments in the US and the UK, as the economic calendar quiets down. The minutes from the FOMC September meeting out on Wednesday will provide some clarity as to the level of dissent in the Federal Reserve over the timetable of future interest rate hikes.

Major currencies in detail:

GBP

All UK economic news was completely overshadowed last week by the announcement that Article 50 will be triggered before March 2017 and the hard line the Conservative party is apparently taking in EU exit negotiations.

Concern for the prospects of Sterling in this political environment had already weakened the currency significantly going into early Friday morning in Asia. However, the actual “flash crash” of over 6% was not triggered by additional news, but rather by automated trading programmes operating in an environment of reduced liquidity, as the traditional players in these markets (investment banks) have been forced to scale back participation.

Last week’s s sell-off leaves the Pound at an historically cheap level. Further, there are some signs that the negative reaction by business and academic leaders is causing the Conservative leadership to backtrack on some of their more aggressive policy proposals. However, it is likely that we will see sharp market gyrations for the foreseeable future. These developments underscore the importance of proper FX risk management strategies.

EUR

The Euro ceded the limelight to Sterling last week and continued to trade in some of the tightest ranges we have seen against the US Dollar.

The minutes of the last ECB meeting provided little support to claims that the ECB is considering tapering down its bond purchase programme. A very weak set of retail sales figures for August released last week provided further incentive for the Governing Council to extend its quantitative easing programme beyond the existing March 2017 timeframe.

We expect lacklustre economic performance and rising political risks in Italy, due to the upcoming constitutional referendum, to keep pressure on the common currency over the coming weeks.

USD

Expectations for a Federal Reserve rate hike before the end of the year remain intact after last week’s US labour market report came in almost exactly as the market expected.

Unemployment ticked up but this was on the back of a large increase in the labour force, as the healthy job market attracts previously discouraged job seekers. Critically, wages continue to increase at 2.6%, or 1.5% in real terms.

The strong labour report suggests that the US economy no longer requires emergency settings of monetary policy. The ISM business confidence indices, particularly the services component, were quite strong.

In our view, the case is almost sealed for another rate increase this year, with the November meeting a real possibility. This week, the release of the minutes for the FOMC September meeting should make for interesting currency trading.

Receive these market updates via email