The most significant development in financial markets last week came out of the US late on Friday afternoon.

Rising US bond yields also buoyed the US Dollar against most G10 and emerging market currencies last week. There were, however, two notable exceptions. The Euro managed to close the week unchanged against the greenback, perhaps a sign that traders are becoming more confident that Le Pen will not be the next French president. The Mexican Peso was once again the best performing major currency, up anywhere from 2 to 5% against its peers on conciliatory comments about NAFTA renegotiation from the new US Commerce Secretary.

Two events should drive currency markets this week. On Thursday the ECB will be meeting and markets will closely scrutinise the statement and press conference for any signs that the ECB is softening its dovish rhetoric. The US payroll report for February will also be released on Friday afternoon. We expect most of the attention to be focused on the pace of wage increases rather than the actual headline nonfarm payrolls and unemployment numbers.

Major currencies in detail

GBP

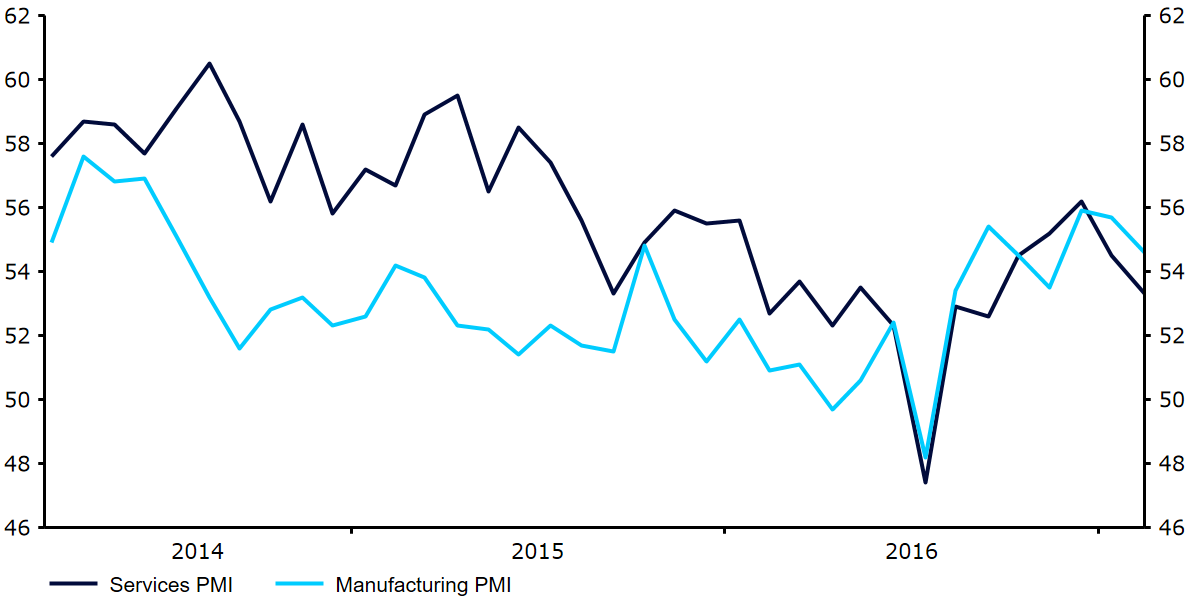

Data out of the UK last week was not kind to Sterling. A sharp drop in both the services and manufacturing PMI’s (Figure 1) was a concerning sign that the uncertainty associated with Brexit is having a negative impact on investment decisions. Positive surprises in consumer spending have so far driven growth, but we expect to see a slowdown unless business investment rebounds, and these PMI numbers are not encouraging.

Figure 1: UK Purchasing Managers’ Indexes (2014 – 2017)

This week, we expect the March Budget to prove uneventful and Sterling to react mostly to news elsewhere, notably US payrolls and the ECB meeting.

EUR

Attention in the Eurozone this week is likely to be split between expectations for the Dutch Election later this month, developments in the French election, and the ECB meeting on Thursday. We expect little change in Draghi’s dovish rhetoric.

Given that relatively strong Euro performance lately has been driven partly by expectations of a change in tone, this could be a catalyst for renewed weakness in the common currency.

USD

Last week showed a mixed batch of second-tier economic indicators out of the US. These, and the short-on-details speech given by Trump to the US Congress, were overshadowed by the flood of hawkish communications from the Federal Reserve. By market close on Friday, rate markets were pricing in a 94% chance of a March hike and a central scenario of three hikes during the whole of 2017.

The payrolls report out this Friday should have little impact in these expectations, which are now roughly in line with our own. We are paying particularly close attention to the hourly wage number, where we expect a significant increase in line with the jump in core inflation and other price pressure gauges.