Euro jumps to January 2015 highs on ECB speculation

- Go back to blog home

- Latest

The Euro jumped to its strongest position in two-and-a-half years against the US Dollar on Monday, ending London trading almost one percent higher.

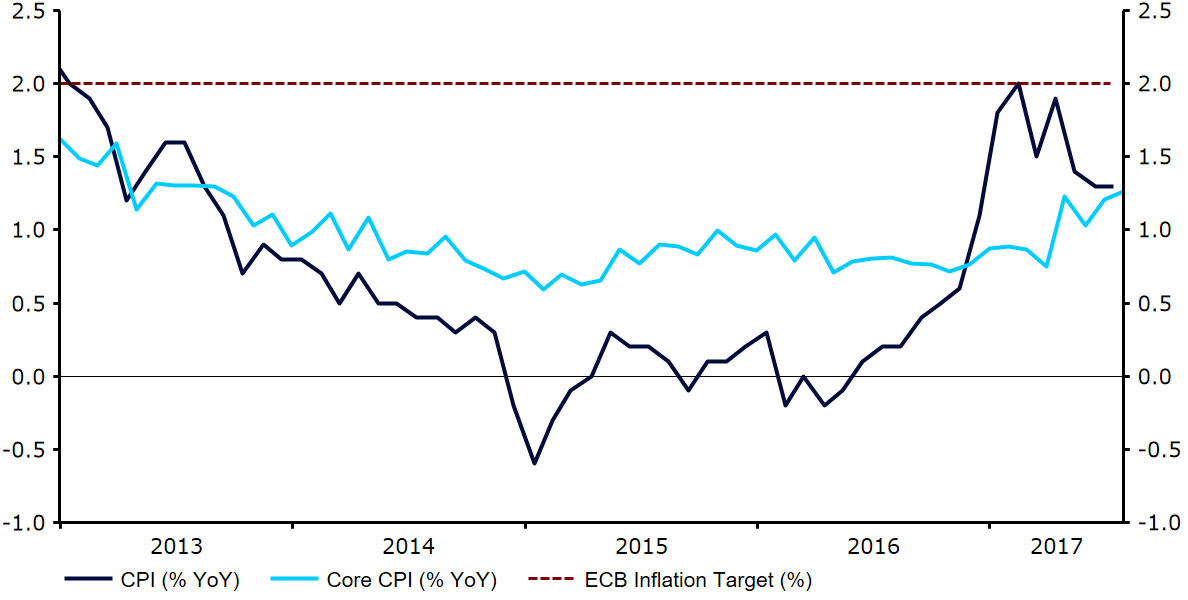

Figure 1: Eurozone Inflation Rate (2013 – 2017)

The latest unemployment news was also encouraging with the jobless rate sliding to an 8 year low 9.1%. Despite the still below target inflation, the general improvement in economic conditions and slightly less dovish comments from Mario Draghi means we think there is a reasonable chance the ECB could announce a winding down of its QE programme when it next meets in September.

Eurozone GDP numbers this morning are expected to show that the economy in the currency bloc expanded 0.6% in the three months to June. We’ll also have the latest manufacturing PMI numbers out of the Euro-area which are expected to remain unrevised from the preliminary flash estimate.

Sterling hits fresh highs as Dollar rout continues

The Pound continued to benefit from broad US Dollar weakness yesterday, soaring to its strongest position against the greenback since September 2016.

The updated manufacturing PMI from Markit showed a modest positive surprise when released this morning, rising to 55.1 from 54.2. However, barring a significant surprise in the services PMI on Wednesday, all attention will be on Thursday’s Bank of England meeting, including the Quarterly Inflation report. With Ian McCafferty and Michael Saunders likely to be the only two MPC members to vote for a rate hike following Kristin Forbes departure from the committee, Governor Carney’s press conference could prove key for Sterling.

Dollar fragile ahead of nonfarm payrolls report

The US Dollar sank to new lows against its major peers as markets opened for the week on Monday. Doubts over Donald Trump’s ability to push through any sort of meaningful policy changes and a pushing back of expectations for Federal Reserve rate hikes has now seen the Dollar index relinquish almost 9% of its value since the beginning of March alone.

Data out of the US was relatively encouraging yesterday, although did little to prevent the sell-off in the Dollar. Pending home sales rose more than expected in June, increasing by 1.5% versus the 1% consensus. The Dallas Fed manufacturing index also increased more than expected, rising to 16.8 last month from the 13.0 forecast by economists.

ISM’s manufacturing PMI this afternoon is forecast to show a modest slowdown on a month previous in July. Markets will also be paying close attention to the Federal Reserve’s preferred measure of inflation, the PCE index, set for release at 13:30 UK time.